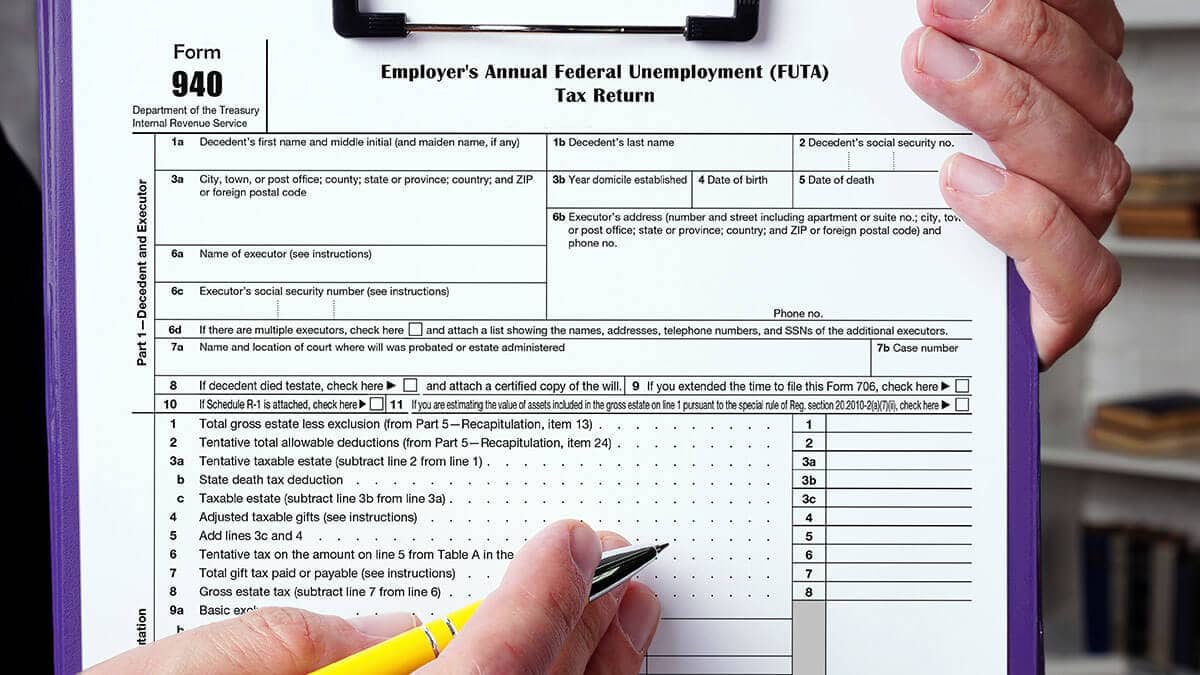

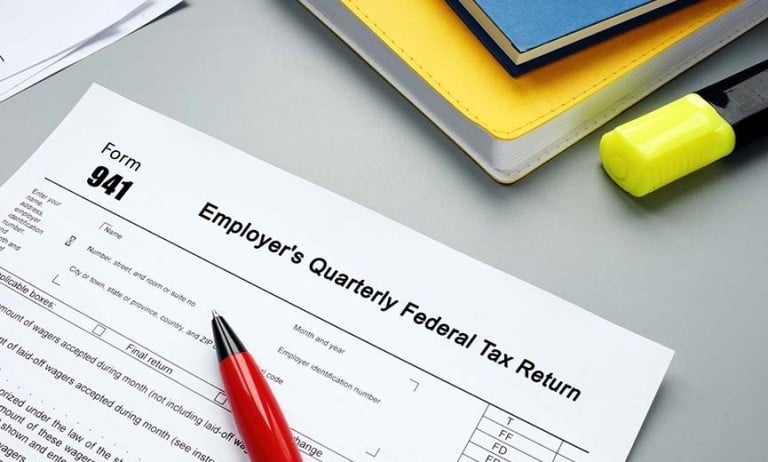

Form 940 Quarterly 2024 – IRS Form 940, the Federal Unemployment Tax Return, is required annually. The filing date is January 31st of the following year. The business must make quarterly payments of FUTA tax once the . If your DBA has employees, annually submit IRS Form 940, “Employer’s Annual Federal Unemployment Tax Return.” Quarterly submit, IRS Form 941 “Employer’s Quarterly Federal Tax Return.” .

Form 940 Quarterly 2024

Source : www.tax1099.comForm 940 and Form 941: Big IRS Updates for 2024

Source : blog.boomtax.comHow to Fill Out Form 940 | Instructions, Example, & More

Source : www.patriotsoftware.comForm 940 Instructions (2024 Guide) – Forbes Advisor

Source : www.forbes.comCornerstone Financial Advisors

Source : www.facebook.comForm 940 Archives | Tax1099 Blog

Source : www.tax1099.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govIRS Form 941: Complete Guide & Filing Instructions | Paychex

Source : www.paychex.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govOliver Rainey & Wojtek LLP

Source : m.facebook.comForm 940 Quarterly 2024 940 vs 941: What’s The Difference Between Them & When to Use FUTA : The 1.45% for Medicare reduces to 0.9% after you reach $200,000 in annual wages. There is no earnings limit or the employer can stop paying FUTA tax on them. Form 940 is the tax form that . Internal Revenue Service. “Topic No. 759 Form 940– Employer’s Annual Federal Unemployment (FUTA) Tax Return – Filing and Deposit Requirements.” .

]]>